This morning, Monday, March 21st, the U.S. Securities and Exchange Commission (SEC) unveiled its long-anticipated draft rule under which companies would disclose their own direct and indirect greenhouse gas emissions, known as Scope 1 and Scope 2 emissions. According to the draft ruling, the SEC would require all publicly traded companies to disclose their greenhouse gas emissions and the risks they face from climate change. It would also require companies to disclose emissions generated by their suppliers and partners, known as Scope 3 emissions, if they are material.

Details

Impacting both ESG reporting and regulatory filing, this proposed rule would mandate that hundreds of businesses report their planet-warming emissions in a standardized way. For many, this would be their first time reporting these emissions. Further, all publicly traded companies would have to disclose their climate-related risks in their financial reports to the SEC and explain how these risks would impact their businesses and strategies. For detailed requirements, see SEC fact sheet.

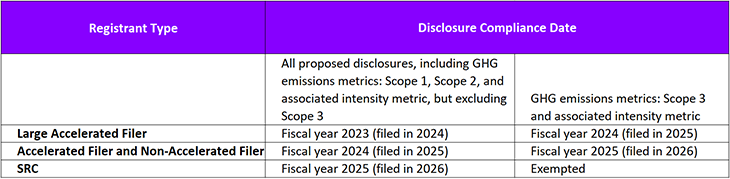

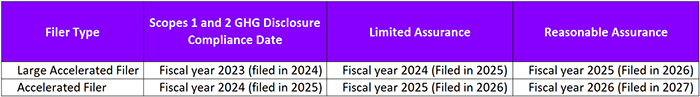

Proposed Timing

The new requirements would begin with a phased approach, starting in 2023 with the largest organizations. Others would have until 2024 to secure information and audit their emissions, supplier and partner data.

As a leader in ESG, and a trusted resource on ESG reporting and regulatory changes, DFIN is ready to support its clients on their ESG journey. We can help prepare for any/all regulatory changes and help clients create a “fit for purpose” reporting and stakeholder communications plan.

DFIN will continue to provide you with the latest updates to ensure that you are prepared and ready for whatever comes next. Continue to watch this space.