Drive your M&A deals forward

Our leading experts and M&A software solutions accelerate deal closing and help you maximise deal value. Simplify the nuances of buying and selling businesses in a global market that requires you to act quickly while collaborating and executing confidently.

The global leader in M&A

Our M&A deal management software is trusted globally by Fortune 1,000 companies, Silicon Valley start-ups, PE firms, investment banks and government agencies to expedite the deal-making process.

Deliver a deal with a one‑stop solution

Up to 50% of M&A deals fail to close. In the moments that matter, ensure you’re leveraging the right M&A software and team of experts to optimise efficiencies, ensure collaboration and minimise reputational risk. This M&A due diligence software gives you the power to handle your merger and acquisition financial management with as little pain as possible.

Purpose-built M&A software for your needs

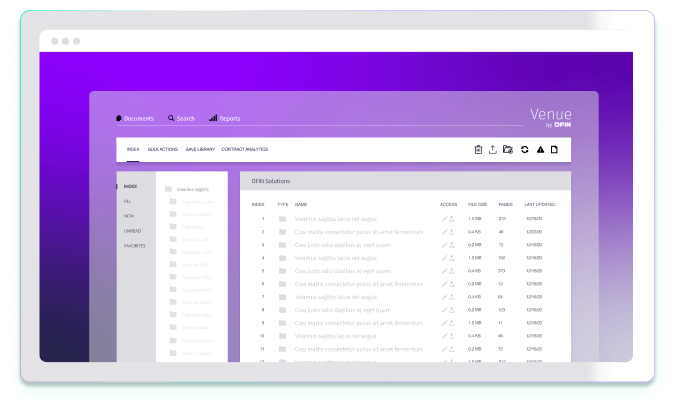

Secure & Analyse your Content

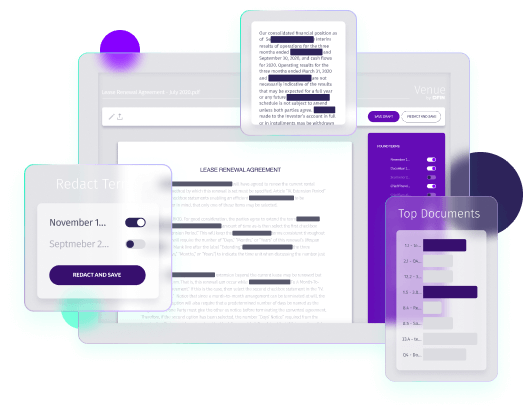

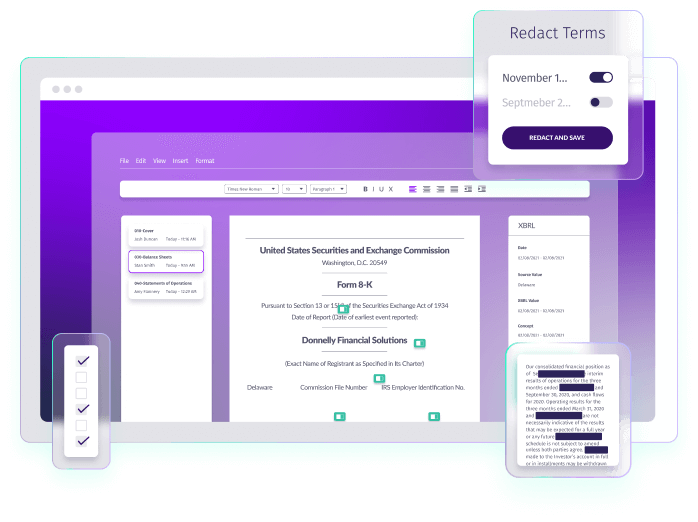

Protect & Mitigate Risk

Organise & Analyse

Streamline Investor Reporting

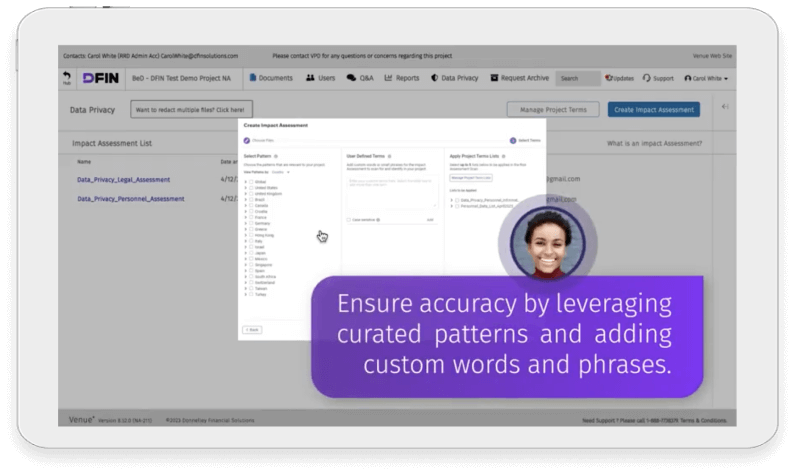

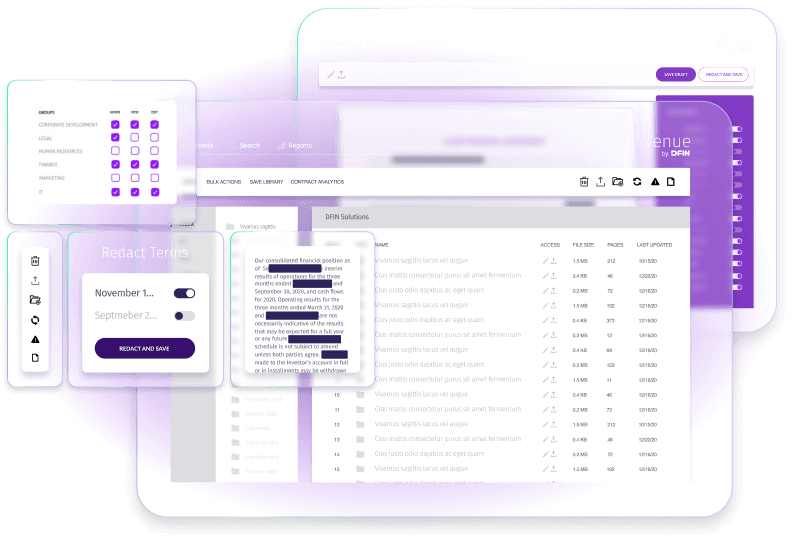

Multi-file Redaction

Explore client results

Accelerate business deals with the same secure platforms for collaboration and analysis that enables a $1.5B acquisition

How we supported one of Asia's largest conglomerates in their global capital markets journey

Get in touch with us for support, pricing or more information.

or

call +44 203 047 6100

Venue checks the security boxes

Venue accelerates critical business moments securely. The DFIN Information Security Program helps to ensure data protection, enterprise cybersecurity and supply chain security using multiple standards, including:

SOC 2 Type II Audits

ISO/IEC 27001:2013 Certification

MFA & SSO Integration

AES 256-bit Encryption at Rest & in Transit

3rd Party Penetration Testing

Role-based Access Control (RBAC)

Intrusion Prevention (IPS) and Detection (IDS) Systems

Meet your extended deal team

Our industry-leading technology and experts take the complexities out of dealmaking. Our 24/7/365 support lets you focus on the deal – we’ll handle the rest. You can count on our M&A solutions and experts to make navigating the process simpler for your team.

Accelerate through every stage of the deal cycle

Accelerate through every stage of the deal cycle

Develop a winning strategy

Evaluate and pursue target companies

Exchange company information

Negotiate an offer

Manage due diligence

Sign the purchase agreement

Guide the integration