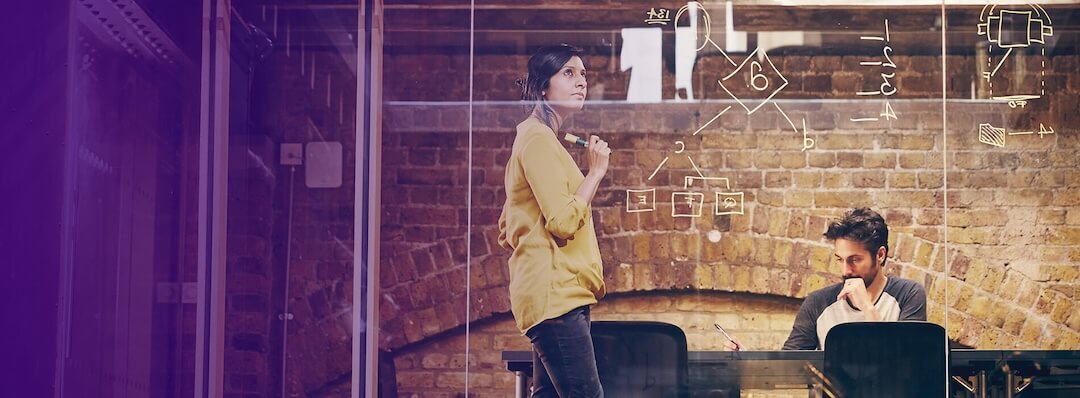

SPAC and De-SPAC Transaction Solutions

DFIN’s end-to-end SPAC (Special Purpose Acquisition Companies) transaction solutions assist companies through the entire process, from launching a SPAC to finalizing the De-SPAC process by merging with a private company. Accelerate your speed-to-success with the powerful, financial ecosystem your team needs to collaborate in real time, avoid regulatory risk, raise capital, and go public faster.

Experience the ease of working with the proven partner to execute your SPAC with confidence

Work the way you want. Discover flexible options and on-demand expertise to minimize risk and reduce overhead at every turn of the transaction. DFIN gives you comprehensive SPAC transaction lifecycle support, with access to experienced professionals, flexibility to meet deal-specific demands and workflow enhancements through our proprietary platforms and global help capabilities. Our SPAC services come together to ensure deals get done faster, with more precision and with fewer compliance concerns.

Business Combinations Serviced by DFIN

Eliminate vendor management headaches by partnering with the leader for the De-SPACing process.

De-SPAC Deal

ARYA Sciences Acquisition II sponsored by Perceptive Advisors was acquired by Bain Capital-backed Cerevel Therapeutics in a reverse merger with an enterprise value of $847 million. The Boston, MA-based company dedicated to treating neuroscience diseases is trading on the Nasdaq under ticker CERE.

Fortress Value Acquisition sponsored by Fortress Investment Group was acquired by MP Materials in a reverse merger with an enterprise value of $1 billion. The Las Vegas, NV-backed owner and operator of Mountain Pass is trading on NYSE under ticker MP.

Gores Metropoulos sponsored by The Gores Group was acquired by Luminar Technologiesin a reverse merger with an enterprise value $2.9 billion. The Orlando, FL-based autonomous vehicle sensor and software company is trading on the Nasdaq under ticker LAZR.

Gores Holdings IV sponsored by The Gores Group combined with United Wholesale Mortgage in a reverse merger that valued it at $16.1 billion. This is the largest de-SPAC transaction to date. The Pontiac, MI-based wholesale mortgage lender started trading on the Nasdaq in 2021 under ticker UWMC.

Conyers Park II Acquisition was acquired by Leonard Green & Partners and CVC-Capital backed Advantage Solutions in a reverse merger with an enterprise value of $5.2 billion. The Irvine, CA-based provider of outsourced sales and marketing services to consumer goods manufacturers and retailers is trading on the Nasdaq under ticker ADV.

De-SPAC Deal

ARYA Sciences Acquisition II sponsored by Perceptive Advisors was acquired by Bain Capital-backed Cerevel Therapeutics in a reverse merger with an enterprise value of $847 million. The Boston, MA-based company dedicated to treating neuroscience diseases is trading on the Nasdaq under ticker CERE.

Fortress Value Acquisition sponsored by Fortress Investment Group was acquired by MP Materials in a reverse merger with an enterprise value of $1 billion. The Las Vegas, NV-backed owner and operator of Mountain Pass is trading on NYSE under ticker MP.

Gores Metropoulos sponsored by The Gores Group was acquired by Luminar Technologiesin a reverse merger with an enterprise value $2.9 billion. The Orlando, FL-based autonomous vehicle sensor and software company is trading on the Nasdaq under ticker LAZR.

Gores Holdings IV sponsored by The Gores Group combined with United Wholesale Mortgage in a reverse merger that valued it at $16.1 billion. This is the largest de-SPAC transaction to date. The Pontiac, MI-based wholesale mortgage lender started trading on the Nasdaq in 2021 under ticker UWMC.

Conyers Park II Acquisition was acquired by Leonard Green & Partners and CVC-Capital backed Advantage Solutions in a reverse merger with an enterprise value of $5.2 billion. The Irvine, CA-based provider of outsourced sales and marketing services to consumer goods manufacturers and retailers is trading on the Nasdaq under ticker ADV.

Knowledge Hub

How DFIN Transformed PropertyGuru’s Financial Reporting Processes to Enable Better Control and Drive Cost Efficiencies

From Private to Public: Expert Insights for Foreign Private Issuers Pursuing U.S. Public Listing in 2024 and Beyond

Mergers & Acquisitions: The Bedroom vs. the Bullpen by Justin Nowicki, Director of Business Intelligence, DFIN

Continue building your perfect tech stack

Virtual Data Room

Safeguard and share your most sensitive documents with all your shareholders. Easy-to-use, secure software includes privacy scans, contract analytics and multi-file redaction for full transparency and regulatory compliance.

IPO

Accelerate your IPO process with our leading-edge technology-based software and expertise. Our experts will help you successfully navigate deal execution intricacies, maximize value and prepare for life as a public company.

Financial Reporting

Take the complexities out of regulatory reporting. Seamless integration, simple onboarding, Microsoft Office compatibility and all the tools you need for fast, secure filings.