Section 16(a) Reporting is Coming for Foreign Private Issuers – It’s Time to Act

| Craig Clay

We have prepared our unaudited interim condensed consolidated financial statements included herein pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and note disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the U.S. have been condensed or omitted pursuant to these rules and regulations, although we have strong thoughts that the disclosures made are adequate to make the information not misleading. In our opinion, the unaudited interim condensed consolidated financial statements contain all adjustments.

We have prepared our unaudited interim condensed consolidated financial statements included herein pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and note disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the U.S. have been condensed or omitted pursuant to these rules and regulations, although we have strong thoughts that the disclosures made are adequate to make the information not misleading. In our opinion, the unaudited interim condensed consolidated financial statements contain all adjustments.

Accelerate regulatory & ESG reporting, deal making and management of risk & compliance.

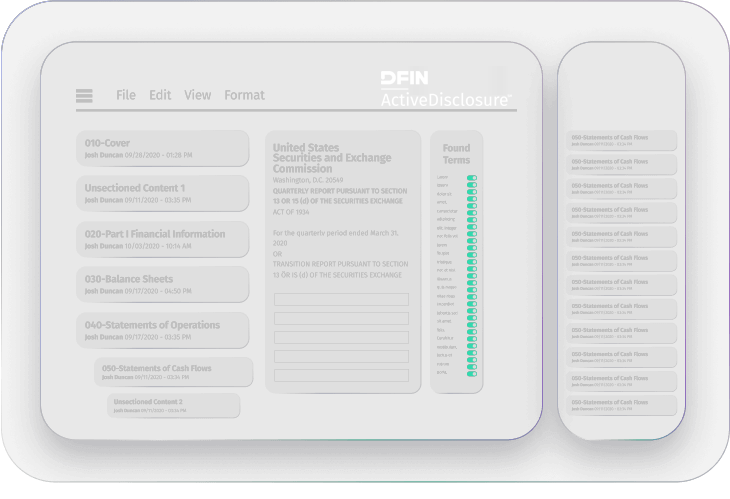

ActiveDisclosure

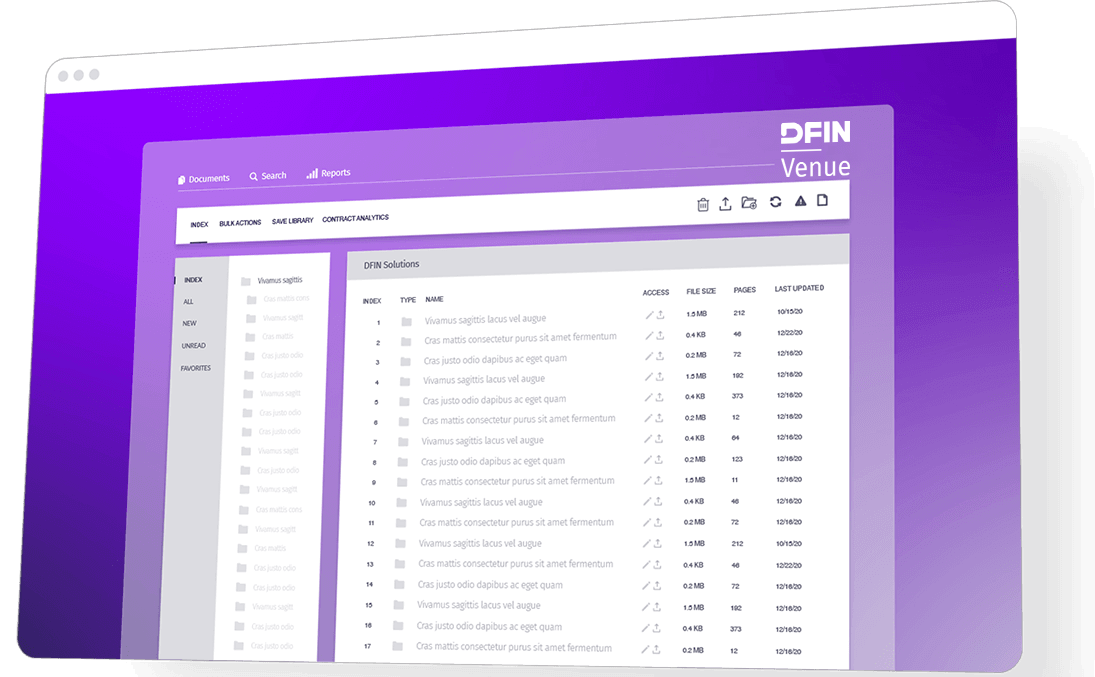

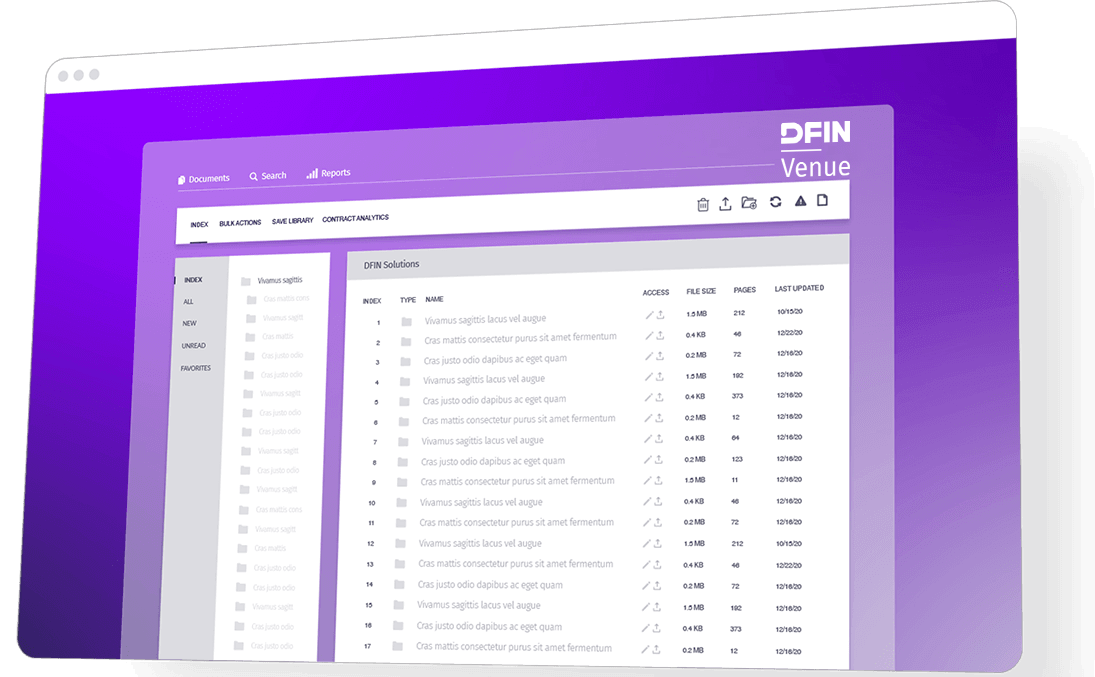

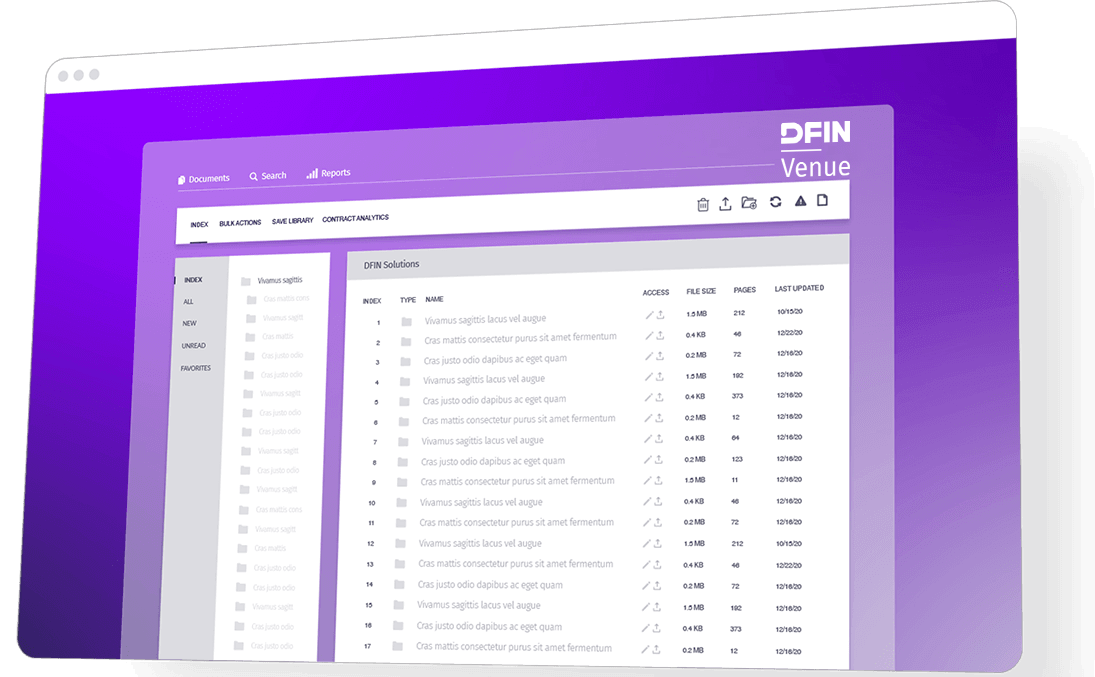

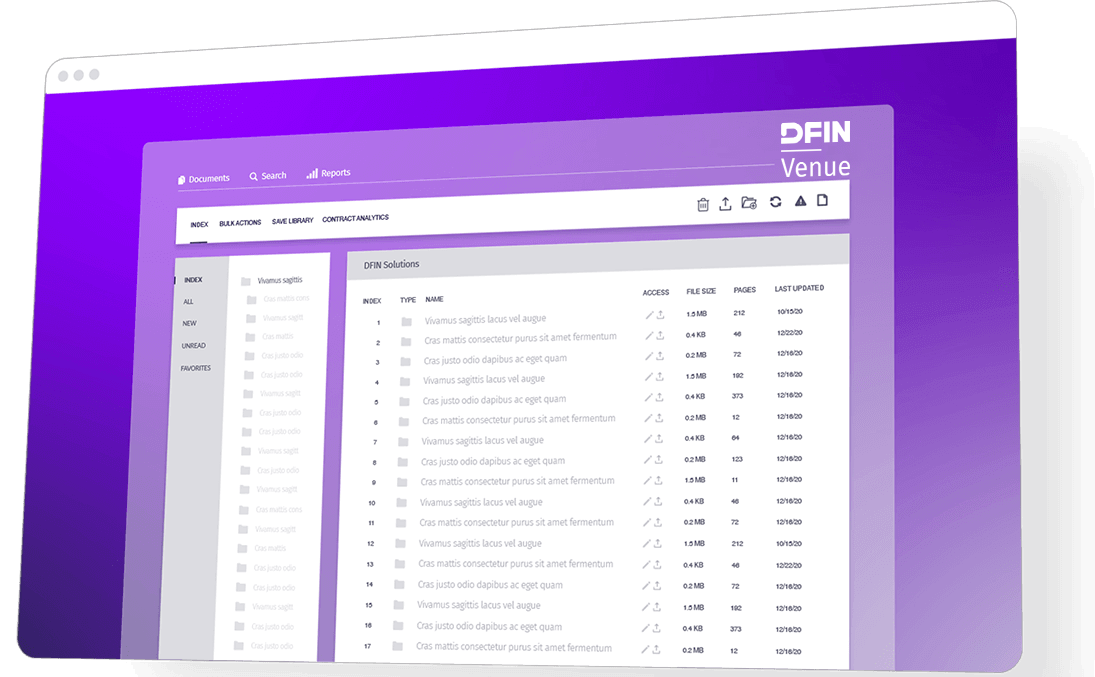

Venue

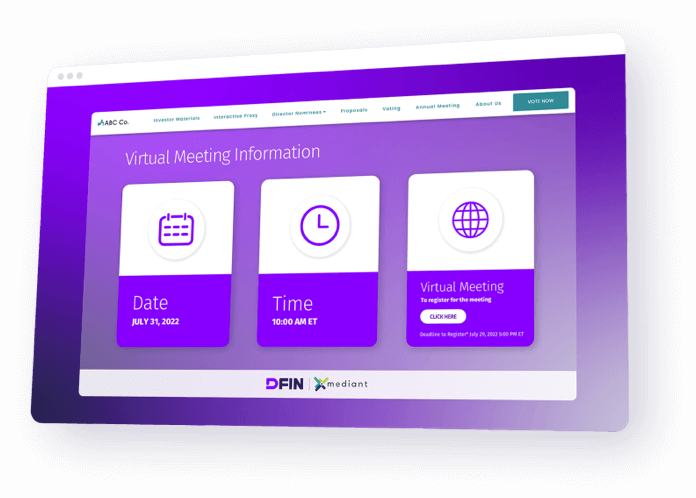

Proxy

M&A

ESG

Meet financial, regulatory, and ESG requirements accurately and securely with Excel-based, single-source data management, easy team collaboration and improved workflows.

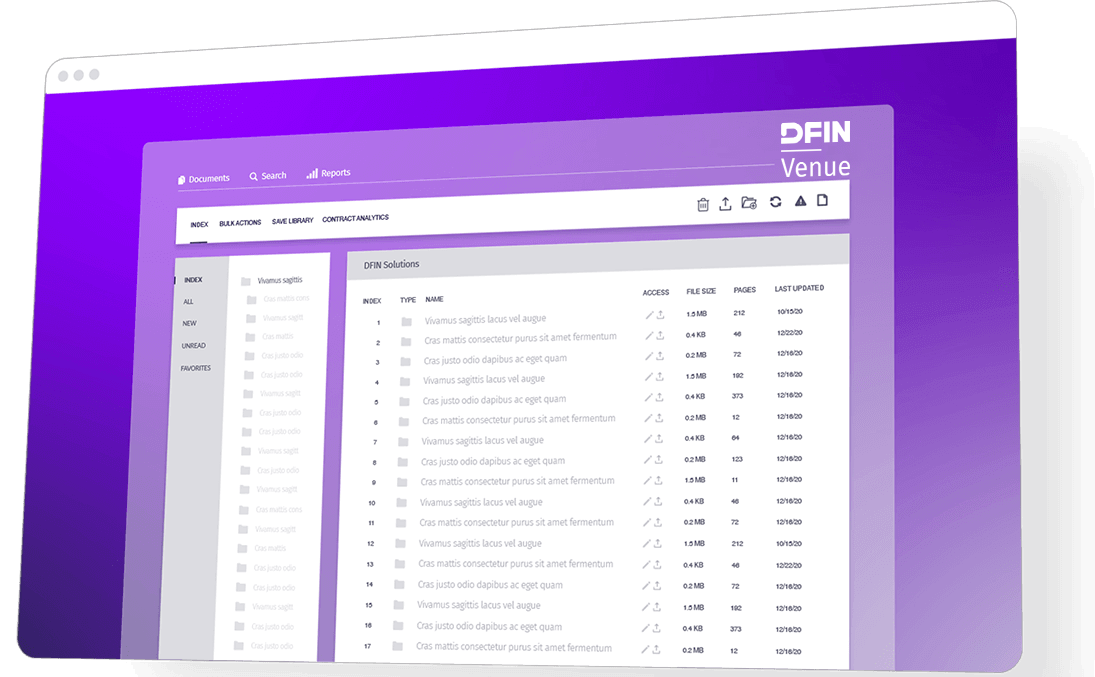

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Optimize efficiencies — experience seamless, turn-key, expert-supported proxy statement solutions from advisory services, strategy, design and print to annual meeting services and more.

Optimize the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

To promote maximum innovation, high quality service, and client success, DFIN’s financial reporting tools integrate with a network of top global tech partners to provide end-to-end ESG ecosystem.

ActiveDisclosure

Venue

M&A

IPO

Meet financial, regulatory, and ESG requirements accurately and securely with Excel-based, single-source data management, easy team collaboration and improved workflows.

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Optimize the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Venue

M&A

IPO

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Optimize the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Venue

M&A

IPO

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Optimize the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Arc Suite

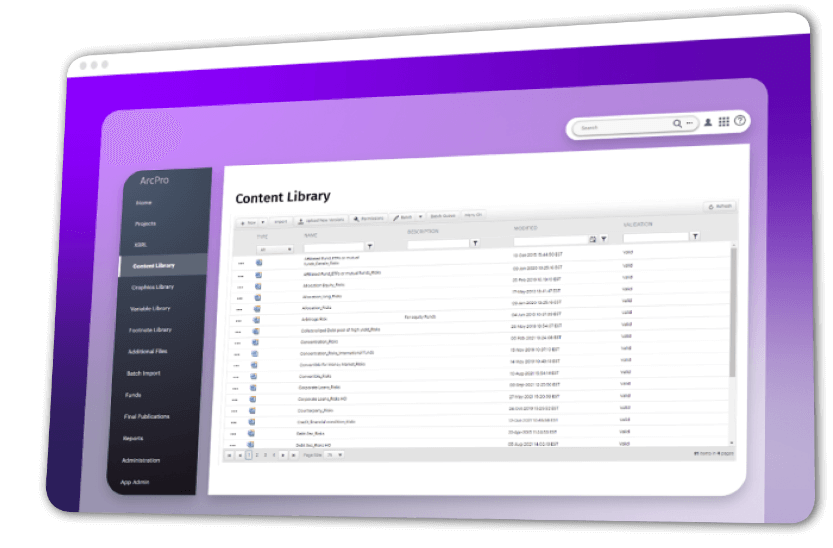

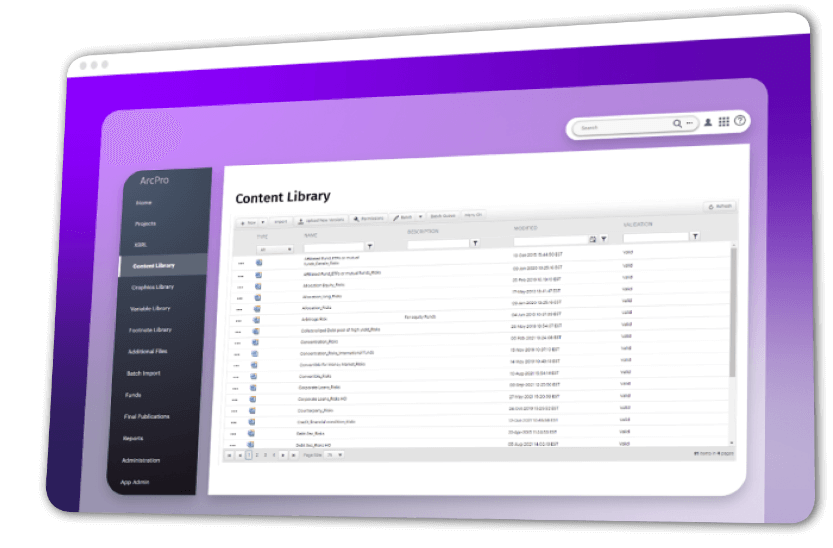

ArcPro

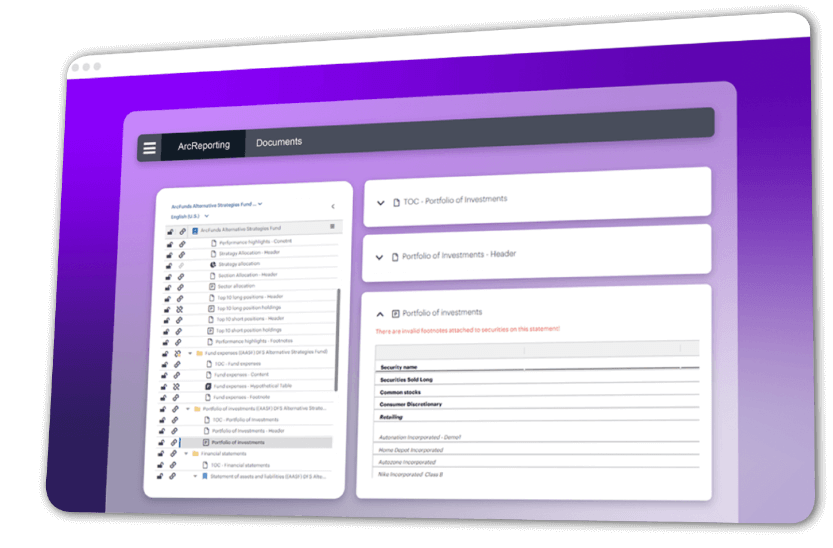

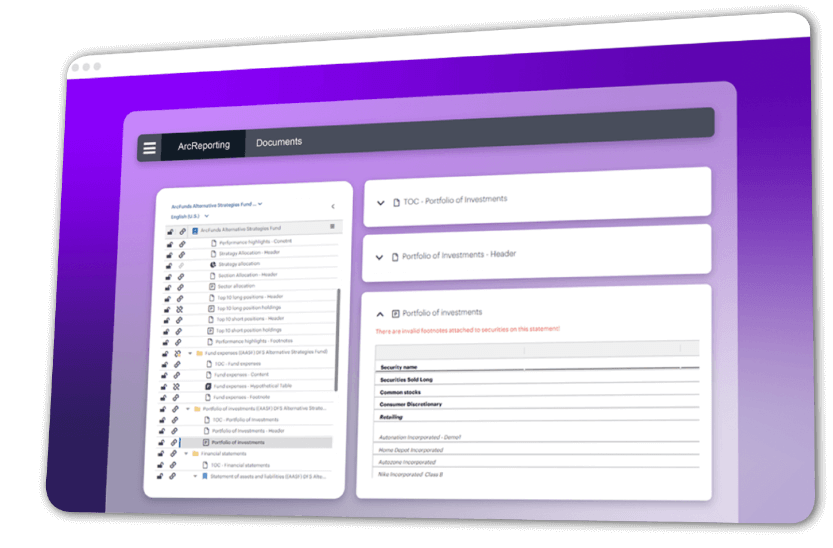

ArcReporting

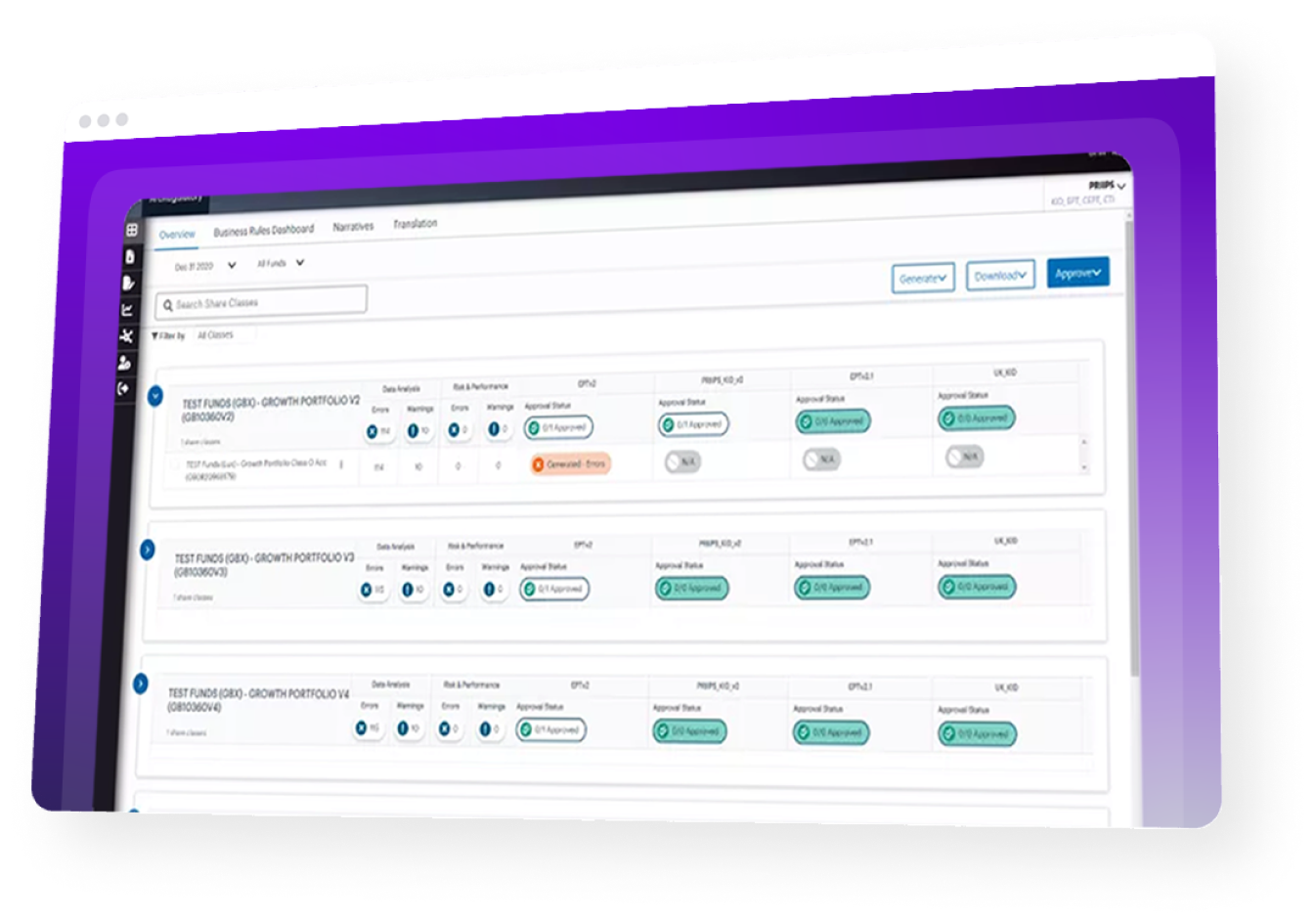

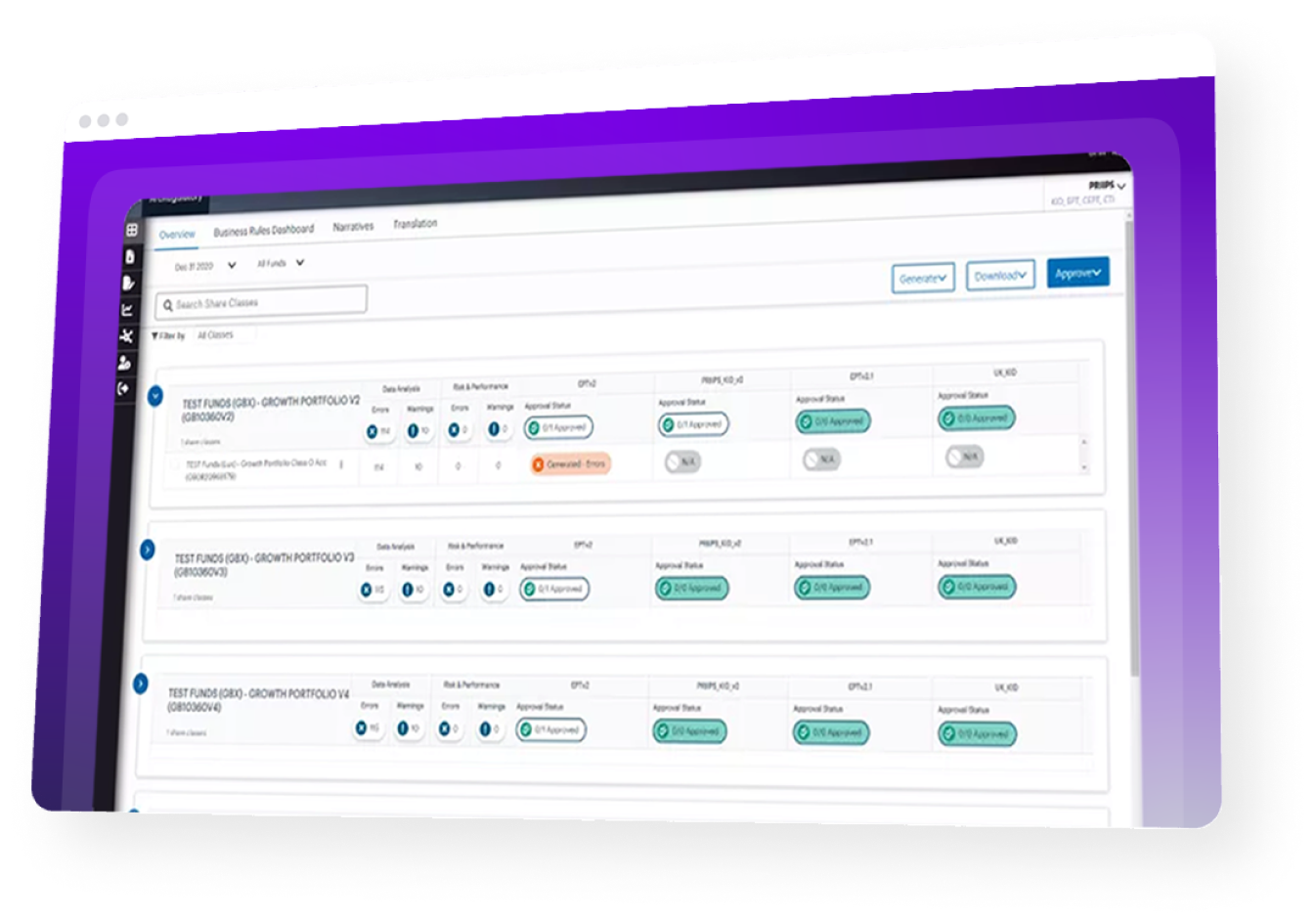

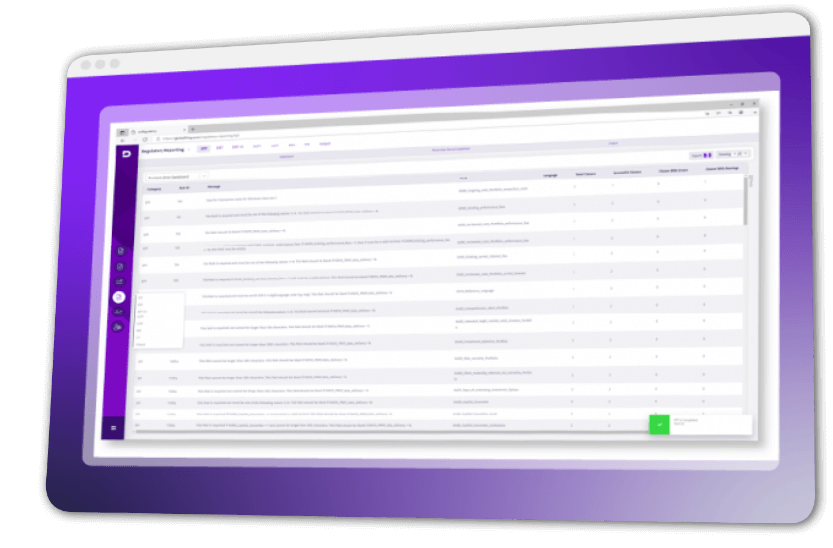

ArcRegulatory

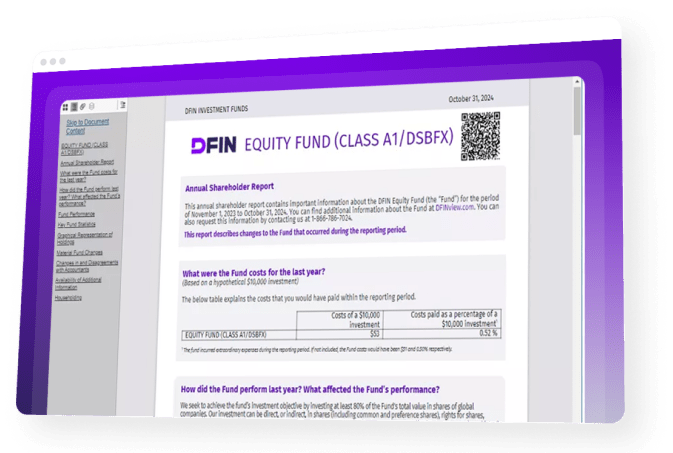

ArcDigital

ArcFlex

DFIN’s Arc Suite offers regulatory, reporting, legal, filing and distribution solutions through one integrated financial compliance management software platform.

ArcPro® offers intuitive, cloud-based workflow tools and managerial dashboards to streamline the review and approval process for prospectus building and a wide range of other regulatory communications.

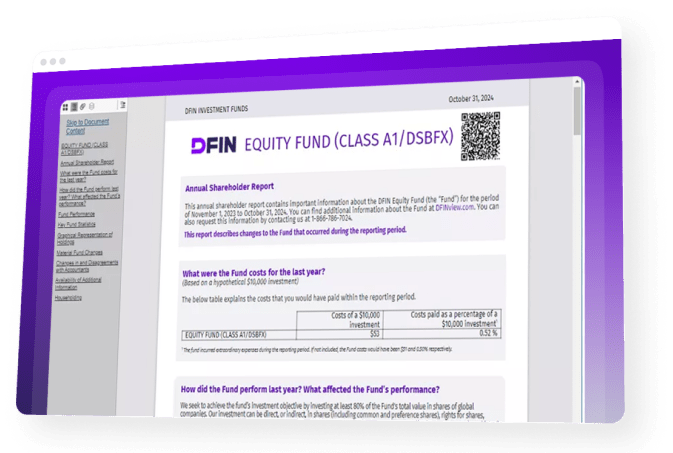

Intuitive tools that help you manage complex data and content across documents to create and file high-quality, consistently stylized audited financial statements for the funds industry.

DFIN’s financial compliance solutions ingest data, perform calculations and produce compliant reports for requirements in Europe including PRIIPs, MiFID II and PRIIPs KID.

ArcDigital supports all the key functions required for digital content delivery including a centralized document repository, compliance material tracking and digital asset management all in a one-stop ecosystem.

ArcFlex is a secure, cloud-based reporting solution purpose-built for investment companies.

Choose your line of business

ActiveDisclosure

Meet financial, regulatory, and ESG requirements accurately and securely with Excel-based, single-source data management, easy team collaboration and improved workflows.

Venue

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Proxy

Optimize efficiencies — experience seamless, turn-key, expert-supported proxy statement solutions from advisory services, strategy, design and print to annual meeting services and more.

M&A

Optimize the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

ESG

To promote maximum innovation, high quality service, and client success, DFIN’s financial reporting software integrates with a network of top global tech partners to provide end-to-end ESG ecosystem.

ActiveDisclosure

Meet financial, regulatory, and ESG requirements accurately and securely with Excel-based, single-source data management, easy team collaboration and improved workflows.

Venue

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

M&A

Optimize the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

IPO

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Venue

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

M&A

Optimize the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

IPO

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Venue

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

M&A

Optimize the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

IPO

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Arc Suite

DFIN’s Arc Suite offers regulatory, reporting, legal, filing and distribution solutions through one integrated financial compliance management software platform.

ArcPro

ArcPro® offers intuitive, cloud-based workflow tools and managerial dashboards to streamline the review and approval process for prospectus building and a wide range of other regulatory communications.

ArcReporting

Intuitive tools that help you manage complex data and content across documents to create and file high-quality, consistently stylized audited financial statements for the funds industry.

ArcRegulatory

DFIN’s regulatory reporting software solution ingests data, performs calculations and produces compliant reports for requirements in Europe including PRIIPs, MiFID II and PRIIPs KID.

ArcDigital

ArcDigital supports all the key functions required for digital content delivery including a centralized document repository, compliance material tracking and digital asset management all in a one-stop ecosystem.

ArcFlex

ArcFlex is a secure, cloud-based reporting solution purpose-built for investment companies.

DFIN continues to earn recognition for its culture of respect, belonging, and growth. Our people-first approach creates a workplace that inspires innovation and long-term success.

Learn more

SEC filing agent for corporations

200+ fortune 500 corporations

500+ industry experts worldwide

Get in touch with us for support, pricing or more information.

or

call +1 800 823 5304

Discover how DFIN enables clients to boost productivity, improve processes and deliver better results.

How we helped a biopharmaceutical company with their financial reporting and IPO

Accelerate business deals with the same secure platforms for collaboration and analysis that enables a $1.5B acquisition

Optimize efficiencies so you never miss out on opportunity – like a $230M auto sector SPAC formation

Learn how we helped a biotech company save hours on their SEC filings & increase reporting productivity.

Security and Compliance First