Over the past few years, the SEC has issued a wave of regulations that have increased the demands for structured data. The updated disclosure regulations requiring iXBRL tagging for variable insurance products follow that trend.

XBRL was adopted by the SEC for EDGAR filings in 2009 starting with public company financial statements using the U.S. GAAP taxonomy. Shortly after, the SEC adopted XBRL for mutual fund risk/return summary information using the U.S. mutual fund risk/return taxonomy. Inline XBRL, or iXBRL, allows filers to embed XBRL data directly into an HTML document, merging machine-readable business reporting data into a human-readable HTML page.

Beginning in 2018, the SEC required iXBRL for large accelerated filers, ultimately requiring all asset management firms to comply. On March 11, 2020, iXBRL was adopted for variable insurance products and a draft VIP taxonomy was posted.

Mutual fund companies initially were allowed to furnish the XBRL in a separate filing within 15 business days of the effective date of the related filing. Starting in 2020, with the introduction of iXBRL, the XBRL was required to be produced inline, therefore eliminating the 15 business days. Variable insurance products are mandated to begin with concurrent iXBRL filings.

Variable insurance products timeline

Beginning January 1, 2022, all active variable insurance products' prospectuses will need to be reordered and a new disclosure added per SEC requirements. Variable products that have filed the optional summary prospectuses have already done so.

Beginning January 1, 2023, variable insurance products that are offered to new investors will be required to tag the applicable items and file iXBRL. First iXBRL filings are expected to be with the May 1 annual update filings.

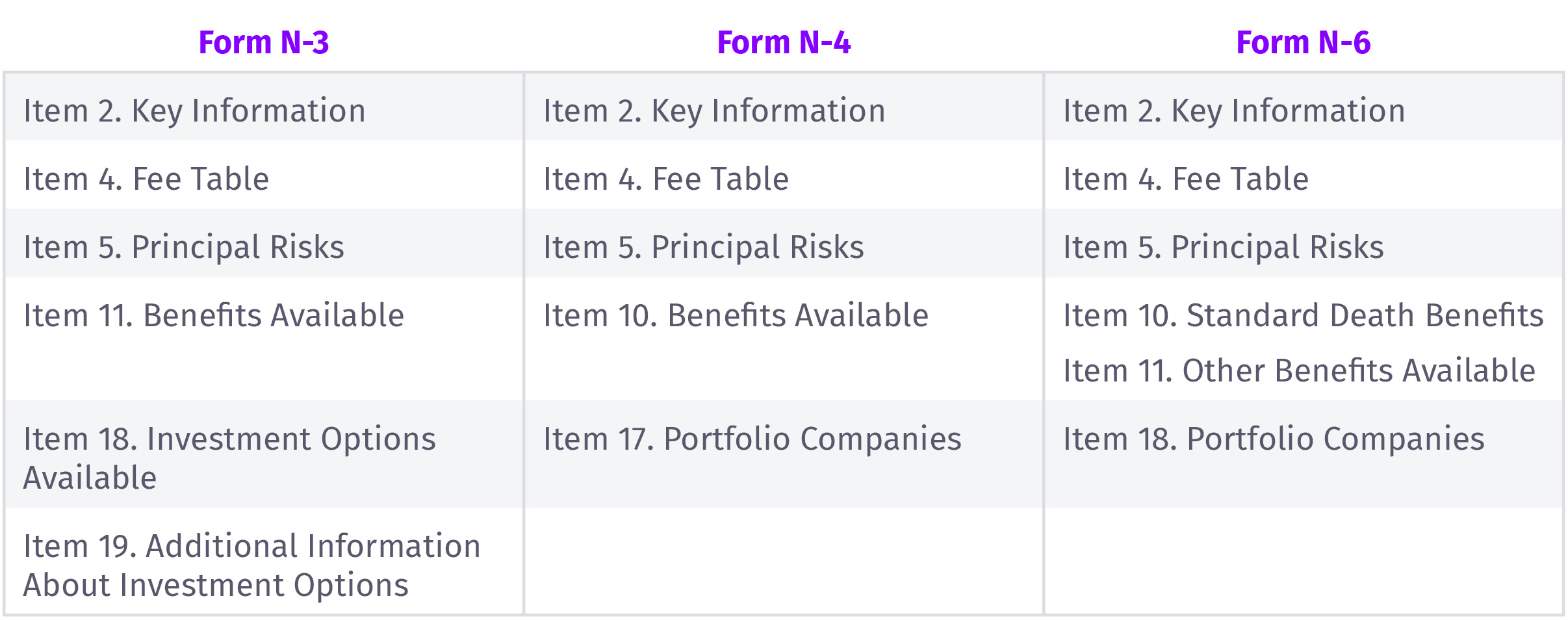

The following table outlines the key information required to be tagged, per the SEC.

Tagged information should make it easy to compare key benefits or features, fees, costs, principal risks of investing, standard death benefits and other available benefits, investment options, taxes and conflicts of interest.

There are several other benefits to iXBRL. Reviewers will be able to view the HTML and XBRL simultaneously and easily navigate between human-readable HTML and machine-readable XBRL. iXBRL reinforces standardization, improving the readability and navigability of disclosure documents while discouraging repetition and disclosure of immaterial information.

There are also key considerations to keep in mind when implementing iXBRL tagging.

Timelines

iXBRL adds an extra layer to review. In addition to reviewing content, you will need to allow time for reviewing tags.

Formatting

iXBRL requires the primary contract (facing sheet through Part C) to be in XHTML format, not HTML. XHTML allows for tagging to be embedded, therefore enabling iXBRL. Secondary documents, such as exhibits, would remain in HTML format.

Redlining

iXBRL filings do not allow for

Tagging requisites

As a prerequisite for tagging, all prospectuses must follow the order/structure prescribed by the amended forms.

Contract requirements

Not all contracts will have iXBRL tagging requirements. Only those offered to new investors will require iXBRL.

As the market leader in iXBRL filings, DFIN is ready to support your iXBRL filing requirements. We'll bring the lessons gleaned from the capital markets rollout and mutual fund risk/return rollout to our insurance industry clients. iXBRL tagging services will range from full-service tagging to supporting client-managed tagging.

iXBRL falls within DFIN's ArcPro content management system, designed to eliminate risk and ensure compliance. Whether you're leveraging a single DFIN solution or taking advantage of DFIN's full capabilities through the Arc Suite platform, we will work with you to determine the best iXBRL solution for your business.