Meet the evolving regulatory challenges for the Alternative Investments market

In recent years, the Alternative Investments market has grown exponentially, representing over 35,000 funds in the U.S. and over 50,000 in the EU. With increased regulatory pressures, traditional spreadsheets and Word documents simply can’t meet today’s complex compliance regulations. DFIN’s Arc Suite® end-to-end solution streamlines the reporting process to drive efficiency and reduce risk.

Still using spreadsheets to manage

and produce your financial statements?

See how the Arc Suite can elevate your processes.

DFIN’s flexible reporting solution for Investment Companies

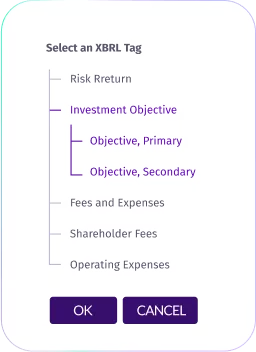

ArcFlex is DFIN’s flexible, cloud-based reporting solution purpose-built for Alternative Investments, Private Funds and Hedge Fund companies and their rapidly changing regulatory needs. It streamlines the creation and editing of financial disclosures while also delivering accurate, audit-ready reports through a centralized, collaborative workspace. ArcFlex is the modern way to simplify complexity, strengthen controls, and stay ahead of global regulatory demands.

Simplify your current Form PF and CPO-PQR processes with ArcRegulatory®

The process of collecting and creating Form PF and CPO-PQR can create time-consuming challenges for asset managers. DFIN’s innovative global regulatory reporting platform, ArcRegulatory, helps simplify the process of collecting and creating Form PF and CPO-PQR through a cloud-based solution.

Accelerate Form SHO reporting with DFIN’s end-to-end solution

From data ingestion and validation to filing directly with the SEC, make short work of Form SHO reporting with expert guidance from DFIN.

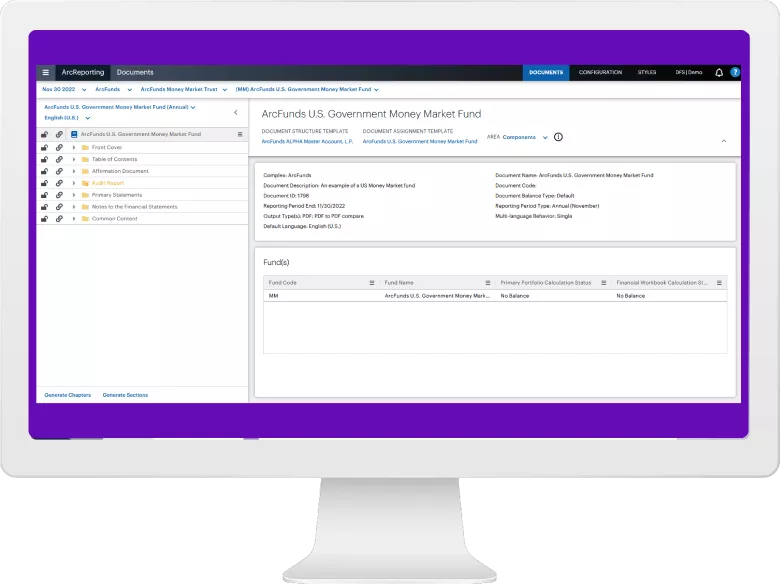

Experience total control over your audited financial statements with ArcReporting®

ArcReporting shareholder reporting software improves your internal controls and reduces the risk of errors. Our intuitive automated financial reporting tool helps you manage complex data and content to create and file high-quality, consistent audited financial statements giving you end-to-end control of your process.

Confidently automate and customize your project management with Workflow

Get top-down visibility into your production cycles and drive efficiency with DFIN’s Workflow. Allow multiple contributors to review documents in parallel, identify bottlenecks and experience the power of email integration.

Experience expert service and industry-leading support — every step of the way

When you work with DFIN, you get:

![]() People ready to help 24/7/365

People ready to help 24/7/365

![]() A solution that incorporates the knowledge and experience of the largest filer to the SEC

A solution that incorporates the knowledge and experience of the largest filer to the SEC

![]() Ongoing recommendations on regulatory changes and industry best practices

Ongoing recommendations on regulatory changes and industry best practices

![]() SaaS solutions that allow IT maintenance and software updates to be managed entirely by the DFIN team

SaaS solutions that allow IT maintenance and software updates to be managed entirely by the DFIN team

Learn more about how DFIN can help enhance your internal controls, increase efficiency and mitigate risk.

or

call +1 800 823 5304