Are You iXBRL Ready?

Make the Easy Transition to with DFIN

Effective June 2020, accelerated filers are required to file their financials in iXBRL format. The good news is that iXBRL actually simplifies filing and DFIN can help you make a seamless transition – even if your whole team is working from home

From Two Filings to One

Until recently, public companies were required to file their financials with the SEC in two different formats: as machine-readable eXtensible Business Reporting Language (XBRL) exhibits and as human-readable documents. That meant twice the work for filers and a risk of discrepancies between the two forms of filing.

The iXBRL mandate changed that. With inline XBRL, companies submit one file that meets both requirements.

The Compliance Timeline

ll filers must make the transition to iXBRL on time to avoid penalties. As a refresher, large accelerated filers began their iXBRL transition last year. Accelerated filers start with their first fiscal period ending on or after June 15, 2020 beginning with their Form 10-Q filing. All remaining filers will comply on or after June 15 2021.

What to Watch For: iXBRL Tip for Filers

Companies required to file with the SEC have been providing stand-alone XBRL exhibits since 2009. Now, with iXBRL, filers simply assign machine-readable XBRL tags to the content in their human-readable (HTML) document .

As complex as it may sound, iXBRL filing is not difficult. With expert advice and the right tools, the transition to iXBRL is an incremental step with only a few easy-to-manage issues to watch for.

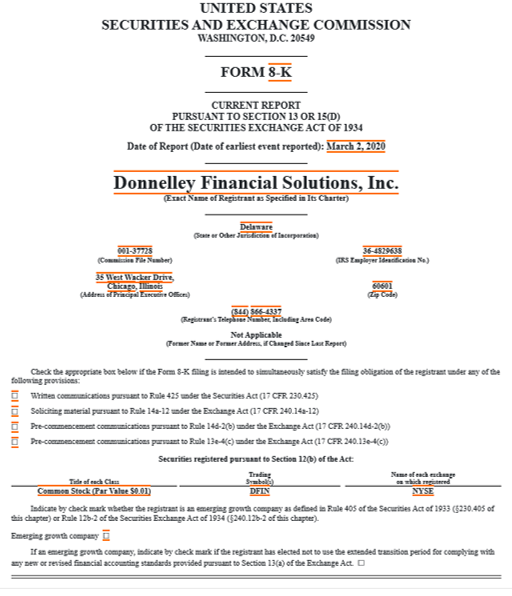

Cover Page Tagging

One of those issues was introduced with the March 2019 amendment to the FAST Act. That amendment extended the requirements for the tagging of Cover Page information. Once a filer is mandated to comply with inline XBRL requirements, the cover page of all Forms 10-K,10-Q, 20-F, 40-F and 8-K filed by the company must be tagged in inline XBRL.

Cover Page Tagging

Under/overscoring indicates

iXBRL-tagged content

To be compliant, cover pages must be tagged per the elements in the 2019 DEI Taxonomy and US GAAP Taxonomy, and these elements must be used in lieu of custom tags. Fortunately, making the move to cover page tagging is easy with DFIN’s expert support. Download the DFIN Tagging Definitions Fact Sheet to learn more.

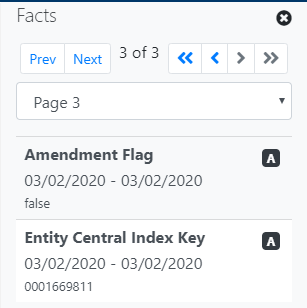

Hidden Facts

Hidden Facts is another issue that has caused some concern for some filers.

When a fact in your filing content cannot be transformed into the proper machine-readable value per the iXBRL Transformation Rules Registry, iXBRL viewer like DFIN’s Online Reviewers Guide and the SEC’s Ix Viewer will display the uppercase letter “A” to flag the disconnect as a Hidden Fact.

For example, a durational fact that appears in filing content as “5.5 years” will be transformed automatically into the machine-readable “P5Y6M” (by the transformation format attribute tag ixt-sec:duryear). However, if the content value contains a dash, as in “5.5-years”, the transformation tag cannot compute the machine value and the iX Viewer will generate a Hidden Fact to indicate that there is a disconnect between the content value and the machine value. (This example is easily resolved by removing the dash.)

Other Hidden Facts are in the filings by design. For example, the SEC requires filers’ CIK numbers to be hidden, i.e., not present in the human-readable filing. The same applies to Amendment Flags. So, CIK numbers and Amendment Flags are required elements that will always generate Hidden-Fact-Not-Found errors and no resolution is required.

Amendment Flag and CIK Hidden Facts

shown in DFIN’s ORG Fact Panel

And some Hidden Facts are simply artifacts of the evolving nature of iXBRL reporting. That is, the data transformation rules are still catching up.

DFIN’s unmatched expertise combined with ActiveDisclosure, the iXBRL-ready disclosure management system, can make cover page tagging, hidden facts and the transition to iXBRL filing simple and seamless whether you’re in the office or working from home.

“The transition did not impact us at all”

Learn how one company made the seamless switch to iXBRL with the DFIN’s expert help.

Make the Transition with Confidence- From Wherever You Are

For filers, the elimination of the requirement to submit both human- and machine-readable formats promotes greater accuracy and simplifies the filing process. Analysts and investors also benefit from the way the iXBRL mandate standardizes financial information, making it easier to compare companies and investment opportunities.

With support from DFIN and a financial reporting solution optimized for iXBRL like ActiveDisclosure, accelerated filers can be ready for the June 2020 deadline.

Partner with DFIN For Your Transition to iXBRL

We’re the experts, the largest filer to the SEC in the industry. Our deep knowledge of iXBRL is built in to our ActiveDisclosure financial reporting solution. And we have helped hundreds of companies make the seamless transition iXBRL.