Understanding Demergers in Corporate Restructuring

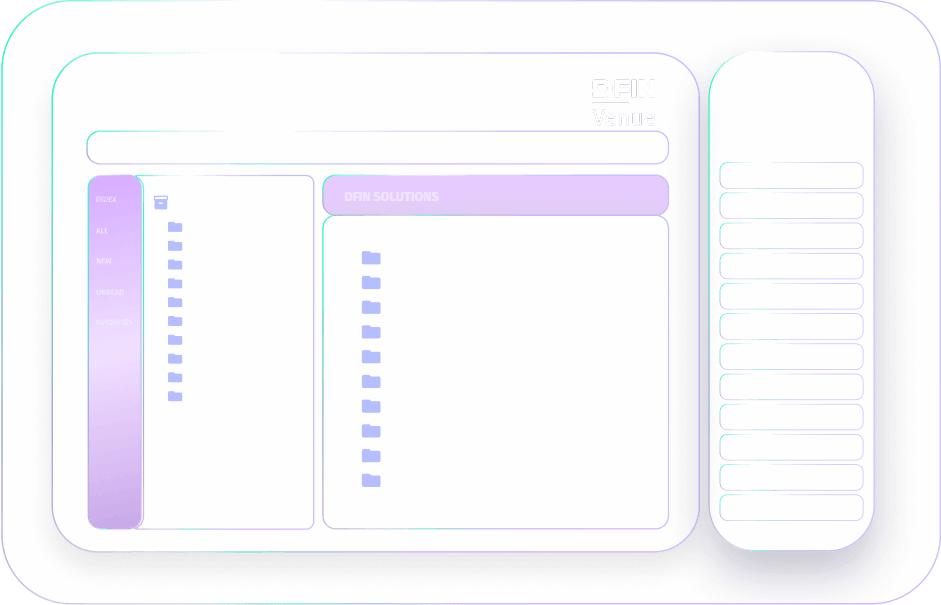

Venue sets the bar for responsive, intuitive, and innovative virtual data rooms by merging reliable technology with best-in-class service. This platform is designed for transactions that require speed, security and scalability.

DFIN is the virtual data room provider trusted by countless businesses to support their global, mission-critical transactions. It’s built for deals that can’t afford delays or data risk, with exceptional high-volume performance as well as streamlined reviewer onboarding. Our live deal experts are available 24/7/365 to assist whenever you have questions or concerns.

100%

of the Top 100 investment banks

100%

of the Top 100 private equity firms

1.4B

Due-diligence content pages hosted annually

15 minutes is plenty of time to see if Venue is a fit for your team

or

call +1 866 245 6044

Support clients during IPOs, mergers, and acquisitions. Venue virtual deal rooms can simplify complex workflows such as IPO due diligence, M&A deal structuring, and cross-border compliance reviews. The Venue VDR reduces friction for multi-jurisdictional deal reviews, enabling seamless collaboration among buyers, counsel, and regulators. With Venue, you can accelerate the time-to-close with version control and audit trails to ensure compliance every step of the way.

Streamline fundraising, investments, and exits. With Venue, you can manage limited partners (LP) reporting, portfolio company document sharing and exit prep in a single, consistent platform. Venue is the leading virtual data room software providing scalablility to accommodate multiple companies and deals, with role-based access to ensure control. It offers the highest degree of performance across mega-funds and high-volume file sharing, as well.

Support transactions across the corporate lifecycle. Centralize your workflows for board governance, regulatory audits, and multi-division transaction support. Venue is an M&A-ready platform that adapts as your strategy evolves.

The Venue virtual data room features bank-grade security for sensitive information, including robust encryption, multi-factor authentication, and role-based access control. This secure document sharing ensures you can prevent unauthorized downloading, printing, or viewing that can create unwanted complications.

These tools are compliant with global regulatory standards including SOC 2, ISO 27001, GDPR and more.

With advanced monitoring tools to track activity on confidential documents and built-in audit trails for full deal transparency, Venue makes every transaction as safe and secure as possible.

SOC 2 Type II Audits

HITRUST Audits Reports

ISO/IEC 27001:2013 Certification

MFA & SSO Integration

AES 256-bit Encryption at Rest & in Transit

3rd Party Penetration Testing

Role-based Access Control (RBAC)

Intrusion Prevention (IPS) and Detection (IDS) Systems